Protocol Architecture

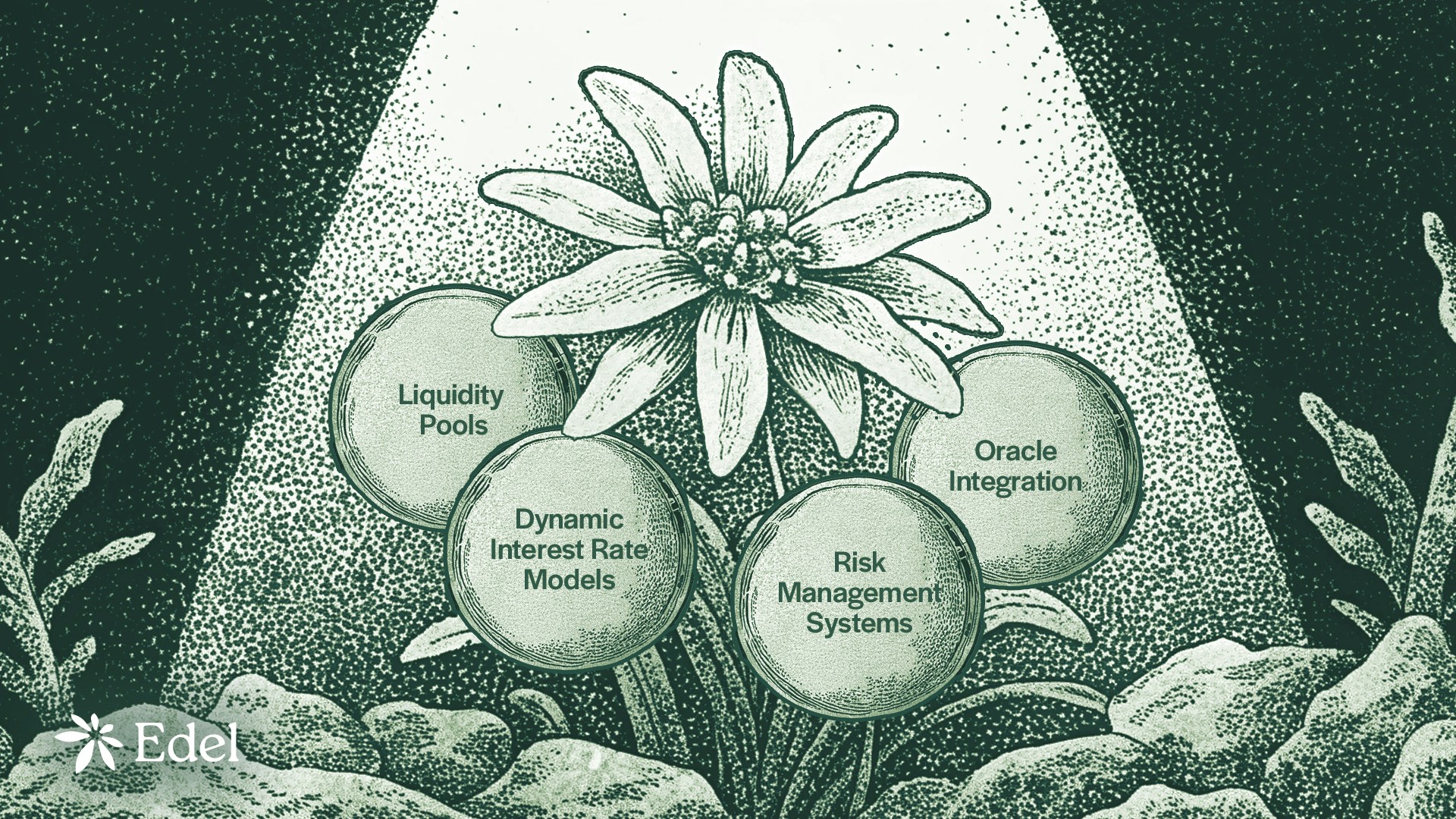

Edel Finance operates through interconnected smart contracts that manage liquidity pools, interest rates, and risk parameters across supported assets:Core Components

Liquidity Pools

Liquidity Pools

- Individual pools for each supported asset (USDC, TESLAON, APPLON, etc.)

- Suppliers provide funds, borrowers access liquidity

- Each pool maintains its own reserves and utilization rates

Dynamic Interest Rate Models

Dynamic Interest Rate Models

- Rates adjust automatically based on supply and demand

- Higher utilization = higher interest rates

- Incentivizes balance between supply and borrowing

Risk Management Systems

Risk Management Systems

- Health Factor calculations for borrowing positions

- Liquidation mechanisms to protect protocol solvency

- Loan-to-Value (LTV) ratios for each asset

Oracle Integration

Oracle Integration

- Real-time asset pricing from Chainlink & native Ondo oracles

- Accurate collateral valuation for borrowing calculations

- Price feeds update to reflect market conditions

How Lending Works

For Suppliers

- Deposit Assets: Supply crypto assets to liquidity pools

- Receive aTokens: Get interest-bearing tokens that represent your deposit

- Earn Interest: aTokens automatically accumulate value over time

- Withdraw Anytime: Redeem aTokens for your original asset plus earned interest

aTokens (like aUSDC, aTESLAON) are ERC-20 tokens that grow in value as interest accrues. They can be transferred or used in other DeFi protocols.

For Borrowers

- Provide Collateral: Deposit assets as collateral (over-collateralized)

- Borrow Assets: Take loans up to your borrowing capacity

- Maintain Health: Keep your Health Factor above 1.0 to avoid liquidation

- Repay Loans: Pay back borrowed amount plus accrued interest

Getting Started

Now that you understand the basics, you’re ready to:Start Supplying

Learn how to deposit assets and earn yield through aTokens

Learn Borrowing

Understand how to access liquidity using your crypto as collateral

Risk Management

Deep dive into Health Factor, liquidations, and position safety

Advanced Features

Explore isolation-mode and portfolio optimization strategies